Table Of Content

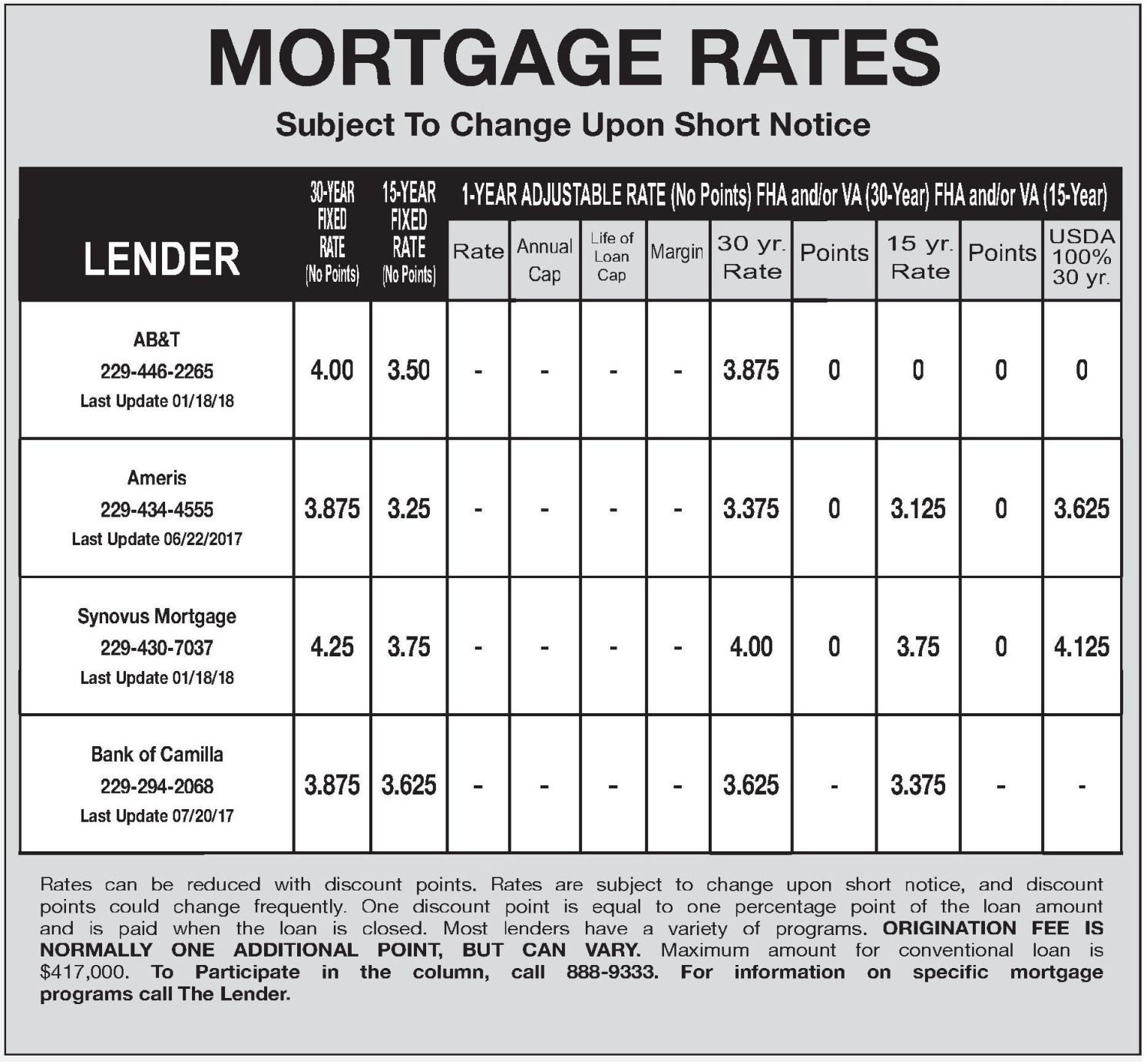

Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas. While an upfront funding fee is required on these loans, your down payment can be as little as zero down without paying PMI. Homeowners in some developments and townhome or condominium communities pay monthly Homeowner's Association (HOA) fees to collectively pay for amenities, maintenance and some insurance.

How we make money

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again? - Forbes

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again?.

Posted: Thu, 25 Apr 2024 16:49:00 GMT [source]

PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment. Lenders tend to give the lowest rates to borrowers with the highest credit scores, lowest debt and substantial down payments.

Mortgage options and terminology

You might not spend this amount each year, but you’ll spend it eventually. On mobile devices, tap "Refine Results" to find the field to enter the rate and use the plus and minus signs to select the "Loan term." Consider stowing at least 1% of the home's market value in savings each year as your long-term household maintenance and repair fund. You may also want to pay someone else to take care of routine maintenance that might have previously fallen on your landlord, such as snow removal, yard care or HVAC tuneups. $900 to $2,500 for most local moves; higher for longer distance, more stuff or additional services.

Mr. 80 Percent

An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan. Explore mortgage options to fit your purchasing scenario and save money. Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

How much are closing costs?

Mortgage lenders are required to assess your ability to repay the amount you want to borrow. A lot of factors go into that assessment, and the main one is debt-to-income ratio. Your mortgage payment will probably be your biggest ongoing expense as a homeowner.

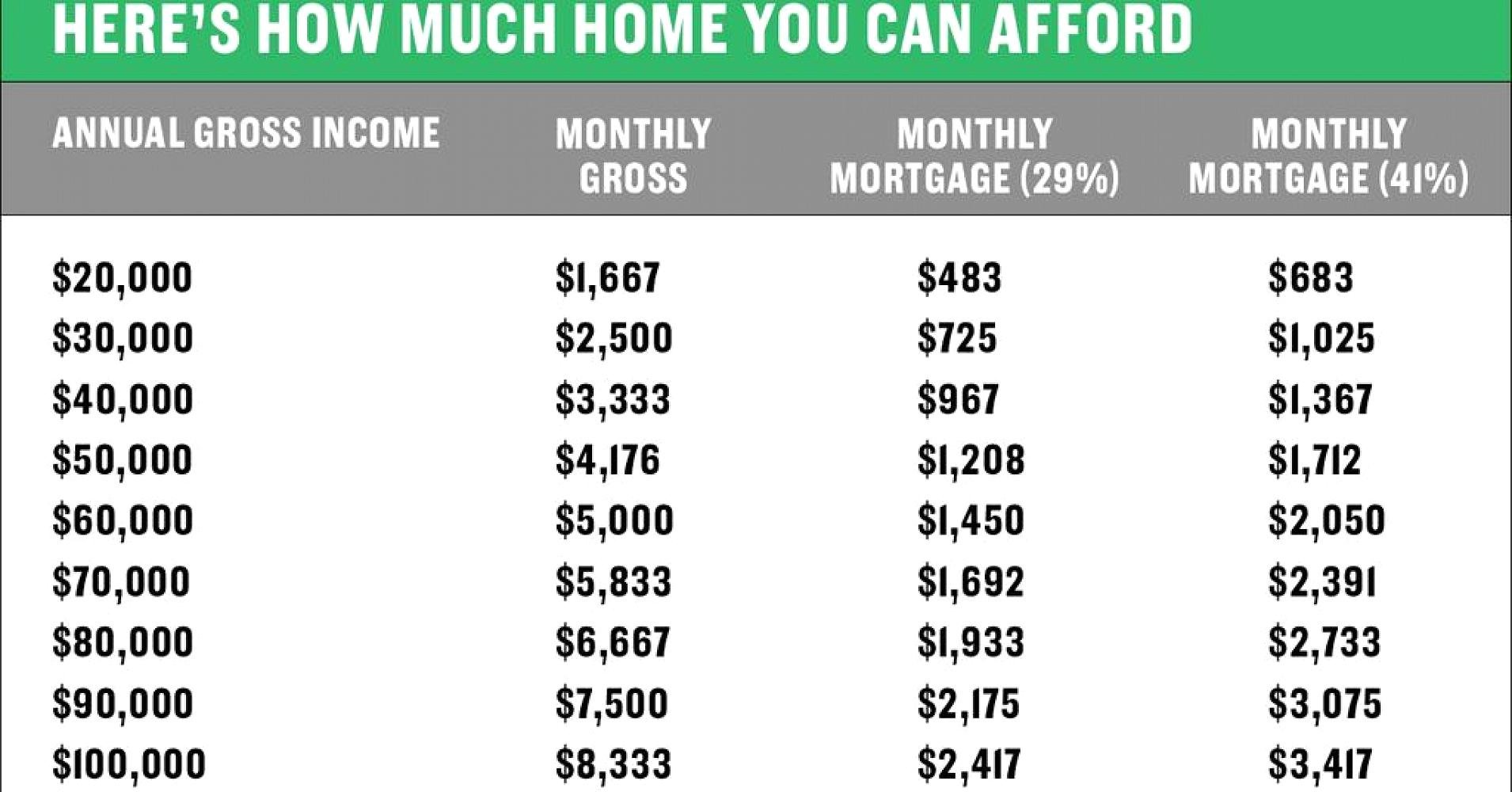

How to calculate your mortgage payments

If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance. You can get private mortgage insurance if you have a conventional loan, not an FHA or USDA loan. Rates for PMI vary but are generally cheaper than FHA rates for borrowers with good credit. Many homeowners opt to have their mortgage servicers pay property taxes on their behalf, keeping the money in an escrow account. That means if your property taxes increase, your monthly mortgage payment will go up in order to cover the tax bill. As you think about your mortgage payments, it’s important to understand the difference between what you can spend versus what you can spend while still living comfortably and limiting your financial stress.

The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. Buying an existing home – The National Association of Realtors’ says the median cost of buying an existing single-family house is about $260,000.

Search for houses to rent by city:

Relocating is a cost, too, whether it's across the country or across town. Professional movers cost more than a DIY move, but you might find the convenience to be worth the price. Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget. These calculators are free and available online, allowing you to experiment with different scenarios and variables whenever you please.

Monthly payment: What’s behind the numbers used in our mortgage payment calculator?

NerdWallet’s mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM. In order to determine how much mortgage you can afford to pay each month, start by looking at how much you earn each year before taxes. Then take your annual income and divide by 12 to determine your monthly income.

Should I Buy A House Now Or Wait? Is It A Good Time? - Bankrate.com

Should I Buy A House Now Or Wait? Is It A Good Time?.

Posted: Thu, 25 Apr 2024 13:41:15 GMT [source]

The city itself is sprawling, covering approximately 469 square miles. It's known for its Mediterranean climate, offering residents sunny days most of the year, mild winters, and warm summers. This weather allows for a variety of outdoor activities, from surfing at Venice Beach to hiking in the Santa Monica Mountains. "I hope they will not move forward with that," he said of the GOP trio that is sponsoring the motion to vacate resolution. "I think we ought to have a contest in November, a deliberative process to select, hopefully, the speaker of the House majority. But I don't think it'd be a wise course of action to do that now."

Ultimately, the house you can afford depends on what you’re comfortable with—just because a bank pre-approves you for a mortgage doesn’t mean you should maximize your borrowing power. If this is your first time shopping for a mortgage, the terminology can be intimidating. It also can be difficult to understand what you’re paying for—and why. Conventional loans can come with down payments as low as 3%, although qualifying is a bit tougher than with FHA loans. If you are buying raw, undeveloped land in a rural setting, you might have to add a septic tank for your wastewater needs.

If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee. Loan requirements for cash reserves usually range from zero to six months. But even if your lender allows it, exhausting your savings on a down payment, moving expenses and fixing up your new place is tempting fate. Closing costs, which will run you about 2% to 5% of the purchase price, will affect how much home you can afford to a greater or lesser extent depending on how you pay for them.

No comments:

Post a Comment