Table Of Content

If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI. Mortgage insurance protects the mortgage lender against loss if a borrower defaults on a loan. Private mortgage insurance (PMI) is required for borrowers of conventional loans with a down payment of less than 20%.PMI typically costs between .05% to 1% of the entire loan amount. Although PMI raises your monthly payment, it may allow you to purchase a home sooner, which means you can begin earning equity. It’s important to speak to your lender about the terms of your PMI before making a final decision. And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise.

Why Should You Use a Mortgage Calculator?

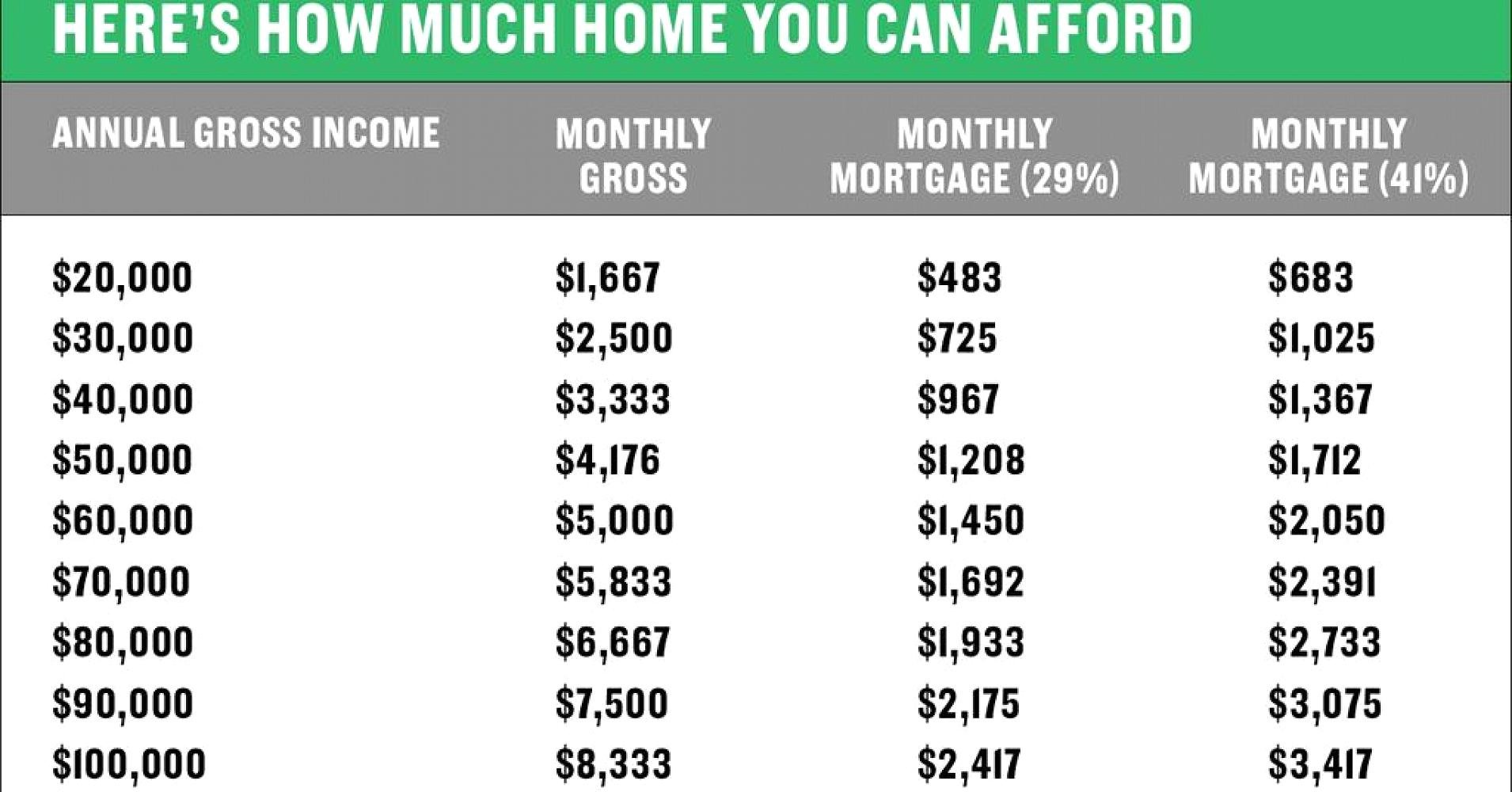

Your debt-to-income ratio is the percentage of pretax income that goes toward monthly debt payments, including the mortgage, car payments, student loans, minimum credit card payments and child support. Lenders look most favorably on debt-to-income ratios of 36% or less — or a maximum of $1,800 a month on an income of $5,000 a month before taxes. If you’re buying a house in a planned development with a homeowners association, or you’re buying a condo or co-op, you’ll probably have a monthly HOA fee on top of your mortgage payment.

What Are the Types of Mortgages?

For a mortgage loan, the borrower often is also referred to as the mortgagor (and the bank or lender the mortgagee). Under "Down payment," enter the dollar amount of your down payment (if you’re buying) or the amount of equity you have (if refinancing). Or instead of entering a dollar amount, enter the down payment percentage in the window to the right. A down payment is the cash you pay upfront for a home, and home equity is the value of the home, minus what you owe. The Federal Reserve Bank of St. Louis, using Consumer Price Index data from the U.S.

Mortgage

However, this is only one area of all the cost of living elements that create your goods and services category. You can also purchase a one-day pass for $3.50 and a seven-day pass for $12.50. Utilities can include a variety of expenses — electricity, gas, water, trash and even internet.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Interest rate

This means when you’re out at The Grove and you spend $1,000, you’ll pay $95 in taxes. Depending on your insurance coverage, and how often you find yourself in a doctor’s waiting room, healthcare will impact your cost of living differently each year. They don’t know how much you spend on groceries, child care, entertainment or travel.

What Income Do I Need to Afford a $300K House? Defining How Much House You Can Get for Your Money - Newsweek

What Income Do I Need to Afford a $300K House? Defining How Much House You Can Get for Your Money.

Posted: Wed, 10 Apr 2024 07:00:00 GMT [source]

The cost of homeowners insurance policy will vary depending on the type of property being insured (e.g. condominium, mobile home, single-family residence, etc.) and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment. Most home loans require a 20% down payment, but Federal Housing Administration (FHA) loans only require a minimum of 3.5%. This type of loan opens the door for many potential homeowners that do not have the savings for a substantial down payment. However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures.

Down Payment Calculator: Calculate Your Down Payment

At least 20 percent down typically lets you avoid mortgage insurance. The longer you can stay in a home, the easier it is to justify the expenses of closing costs and moving all your belongings — and the more equity you’ll be able to build. When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if you’re expecting a baby and want to save additional funds. Depending on your credit score, you may be qualified at a higher ratio, but generally, housing expenses shouldn’t exceed 28% of your monthly income. Depending on where you live, your building permit costs will range from $400 to $4,000, and inspections will cost an average of $5,000.

How much of my income should go towards paying a mortgage?

A basic unfinished 2,400-square-foot pole barn shell costs $20,000 to $40,000. For potential homeowners looking to save money, building your own home costs about $70 per square foot and will save an average of 25%. On a typical home costing $248,000, you would save around $62,000.

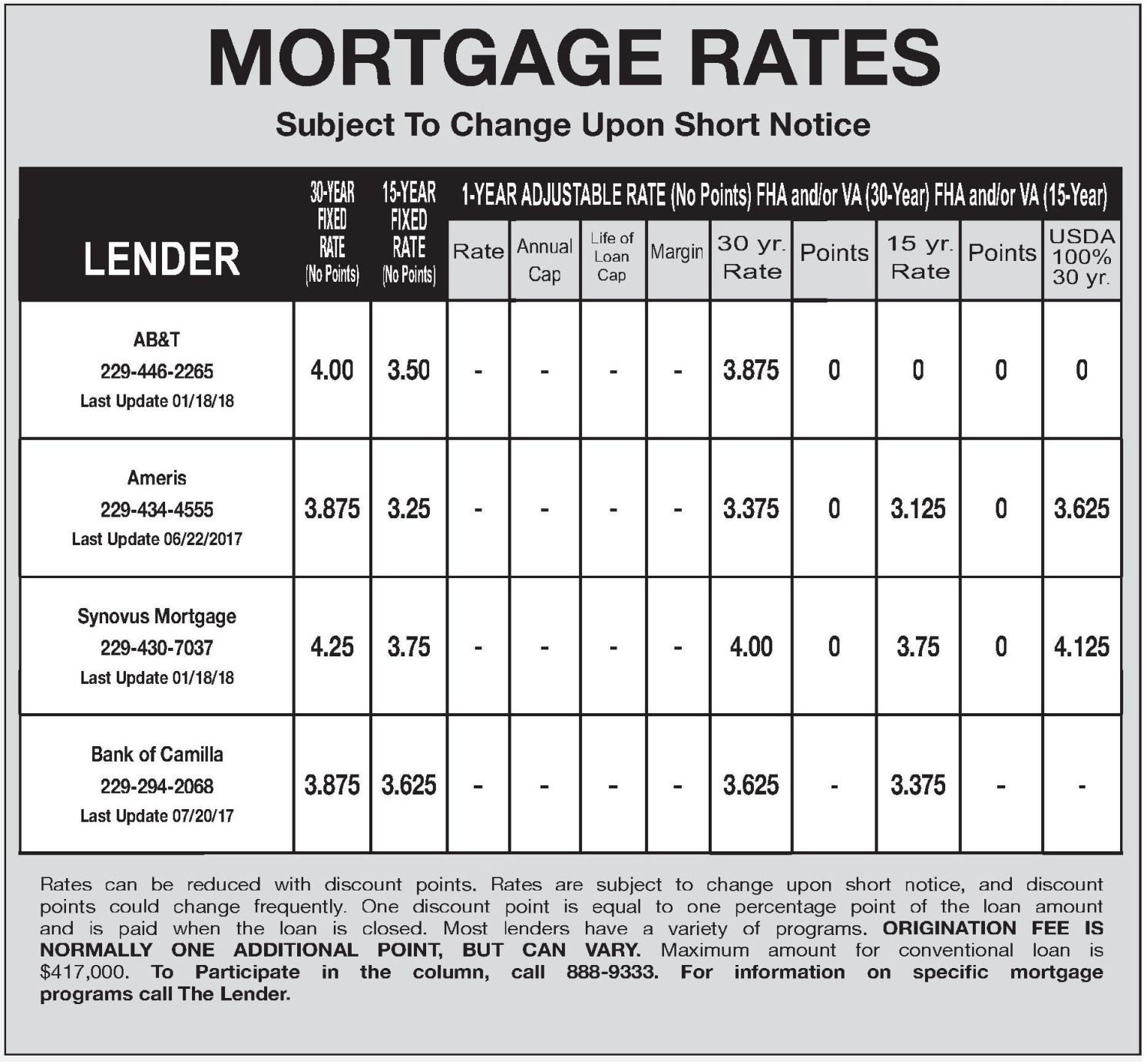

New home construction for a 2,000-square-foot home costs $201,000 to $310,000. Clever said if mortgage rates dropped to 2.5% tomorrow, the same household would be able to afford a home that cost $300,000 — underscoring the impact of high mortgage rates on affordability. A key factor in whether or not you can afford a home is based on the mortgage rate offered. And with current mortgage rates doubling in 2022, it has been a top factor in slowing down home purchases heading into 2023. Even a few basis points can make the difference between a home being affordable or out of reach (a basis point equals one-hundredth of a percentage point).

While living in La La Land will cost you 51.9 percent more than the national average, roughly 4 million people living in this desert oasis make it work — and so can you. You might not want to borrow the maximum amount a lender offers you. Lenders don’t have a complete picture of your financial situation, despite all the paperwork they ask for. A general guideline when calculating how much home you can afford with your salary is to multiply your income by at least 2.5 or 3. This should give you an idea of the maximum housing price you can afford.

Other options for building a guest house include tiny homes, container homes, and modular homes. In many cases, one of these could be cheaper and finished out faster. The average cost to build a house is $248,000, or $100 to $155 per square foot depending on your location, the size of the home, and if modern or custom designs are used.