Table of Content

Withdrawing from other sources, such as an investment or bank account, can bring higher risk and make a dent in your current savings. Calculate your home equity by subtracting your current mortgage balance from the current value of your home. If the current value of your home is $400,000 and you owe $300,000 on your mortgage, your home equity is $100,000.

Combine this with the financing you will need for your second home, and it’s likely you will end up with three mortgages for only two properties. A home equity loan can make buying a second property less expensive and give more liquidity to the buyer. When using home equity specifically to buy an investment property, there are a few distinct advantages. From an interest-rate perspective, a home equity loan may be safer because its interest rate is fixed, while the rate on a HELOC is variable. Borrowers with HELOCs have some protection in the form of caps on how quickly their interest rates can rise, although that can vary from lender to lender. Before you apply for a home equity loan to buy another house, it’s worth considering the alternatives.

What are my best options?

Like a home equity loan, a home equity line of credit also lets you borrow against the value of your home. Instead of a lump sum, however, HELOCs distribute funds via revolving credit so you can take out funds as you need them and only make payments on what you actually borrow. Sometimes referred to as a second mortgage or home equity installment loan, a home equity loan is a lump-sum, fixed-term loan using the equity in your current home as collateral. Like any loan, you pay back what you borrow plus interest by making payments according to the loan’s terms. Whether you’re looking for a summer cabin or investment property, it’s worth exploring home equity loans. We’ll dive into how home equity loans work and the advantages and disadvantages of using equity to buy a second property.

Buying a second property with this money can be a great decision for those who are looking make money from real estate through an investment property. We’ll delve further into the topic of using equity to buy another house in this detailed guide. Down payments don’t just protect the lender—they also reduce the risk of negative cash flow or becoming upside-down on a property. Always calculate your cash-on-cash return before buying any property, and use conservative estimates to avoid losing money rather than earning it. If you have equity in your home and are considering buying another house, it may be worthwhile to sell and buy the new home. This will allow you to make a larger purchase without having two mortgages at once.

Your Home Equity Loan Interest Payments Will Likely Not Be Tax-Deductible

A home equity loan gives you a lump sum of cash, which you pay off with consistent monthly payments in addition to your current mortgage payment. Home equity loans usually have fixed rates and because your home serves as collateral, rates are typically lower than unsecured loans, like credit cards. Home equity loans are also called second mortgages or home equity installment loans. When you use your existing equity to finance a second home you stand to lose your primary home if you fall behind on the loan payments.

Home equity can be a great source of funds when you need a large, lump sum of cash, such as when you’re buying another home. However, you may have to pay several thousand dollars in closing costs, so you won’t walk away from the deal with the full 85%. Like regular mortgages, home equity loans are secured by your home, so you will be putting it at risk if you’re unable to repay the loan. If you’re interested in using home equity to purchase a new home, the value of your house will need to be high enough to support the loan, and you’ll have to meet your lender’s requirements. Each week, Zack's e-newsletter will address topics such as retirement, savings, loans, mortgages, tax and investment strategies, and more.

Can I use a home equity loan to buy another house?

A reverse mortgage can be used to purchase another home, but the catch is that the home that is purchased needs to be the primary residence. Investing in real estate has long been referred to as one of the best avenues to invest money, by the experts. You can then use this money for anything you may need, whether it’s your child’s college education or to pay off your credit card. Let’s talk about whether you can use your home equity to buy another house and how it all works.

This is due to the fact that your home is held as collateral on the loan, but it doesn’t mean you have to wait to sell. All homeowners are technically vulnerable to these shifts, but by owning two properties, you are essentially doubling your potential risk to changes in the housing market. If either home’s value lessens, you may end up owing more on your mortgage and home equity loans, which can spread some homeowners too thin.

Buying a second home with the intention of turning it into an investment property, however, can be beneficial. Rent collections on an investment home or vacation property can help cover the payments on your home equity loan. To ensure that you get the lowest possible interest rates and most competitive loan terms, shop around before committing to a lender.

If you can’t pay it back, then you’ll owe income taxes and possible penalties. The major advantage of using a home equity loan to buy a second home is that it may be your best significant source of funding if you find yourself house-rich but cash-poor. Another potential plus is that interest rates on home equity loans often will be lower than other forms of borrowing, though they are typically higher than interest rates on a mortgage. Using a home equity loan to buy a new house can jeopardize your primary home if you’re unable to handle the payments.

A HELOC is a revolving line of credit that works similarly to a credit card, whereby you can take what you need out of it, when you need it, for a period of time. There are 2 phases to a HELOC, the draw period and the repayment phase. Real estate investors should think in terms of building a “financing toolkit” of lenders and borrowing options. The more options in your toolkit, the more creative you can get in funding real estate deals. You buy a new property, and the lender approves you for an 80% LTV loan. Rather than put down 20% in cash, you offer up your existing property as additional collateral for the loan.

While Discover Home Loans does not currently offer HELOCs, Discover does offer amortgage refinancethat can refinance your HELOC into a new home equity loan with a low, fixed rate. Many lenders will only offer home equity loans for a CLTV up to 80%, while Discover Home Loans offers home equity loans for less than 90% CLTV. This maximum CLTV is to protect the lender from distributing a loan to a homeowner who could owe more on mortgage loans and home equity loans than their house is worth. A cash-out refi basically replaces your existing mortgage and adds on an additional amount above what you currently owe. “The difference between the loan payoff amount and any closing costs is the cash you can net from the cash-out refi,” said Brown. The greater likelihood of being able to afford an investment property via a home equity loan in comparison to a second home, which typically requires larger down payments and better credit.

She has an undergraduate degree from Baylor University and is currently a candidate for CFP certification. You can find her work on sites such as MSN, Yahoo! Finance, Fox Business, Investopedia, Credit Karma, and much more. Homeowners should take special care to note each of these important consideration and choose the proper financing method accordingly. Failing to do so could prove to be a complex—and sometimes, expensive—lesson in homebuying. It’s important for homeowners to take proper considerations before making a decision on how to finance the purchase of their second home. Using home equity to buy a property has clear benefits, but there's risk involved whenever you're using your home as collateral.

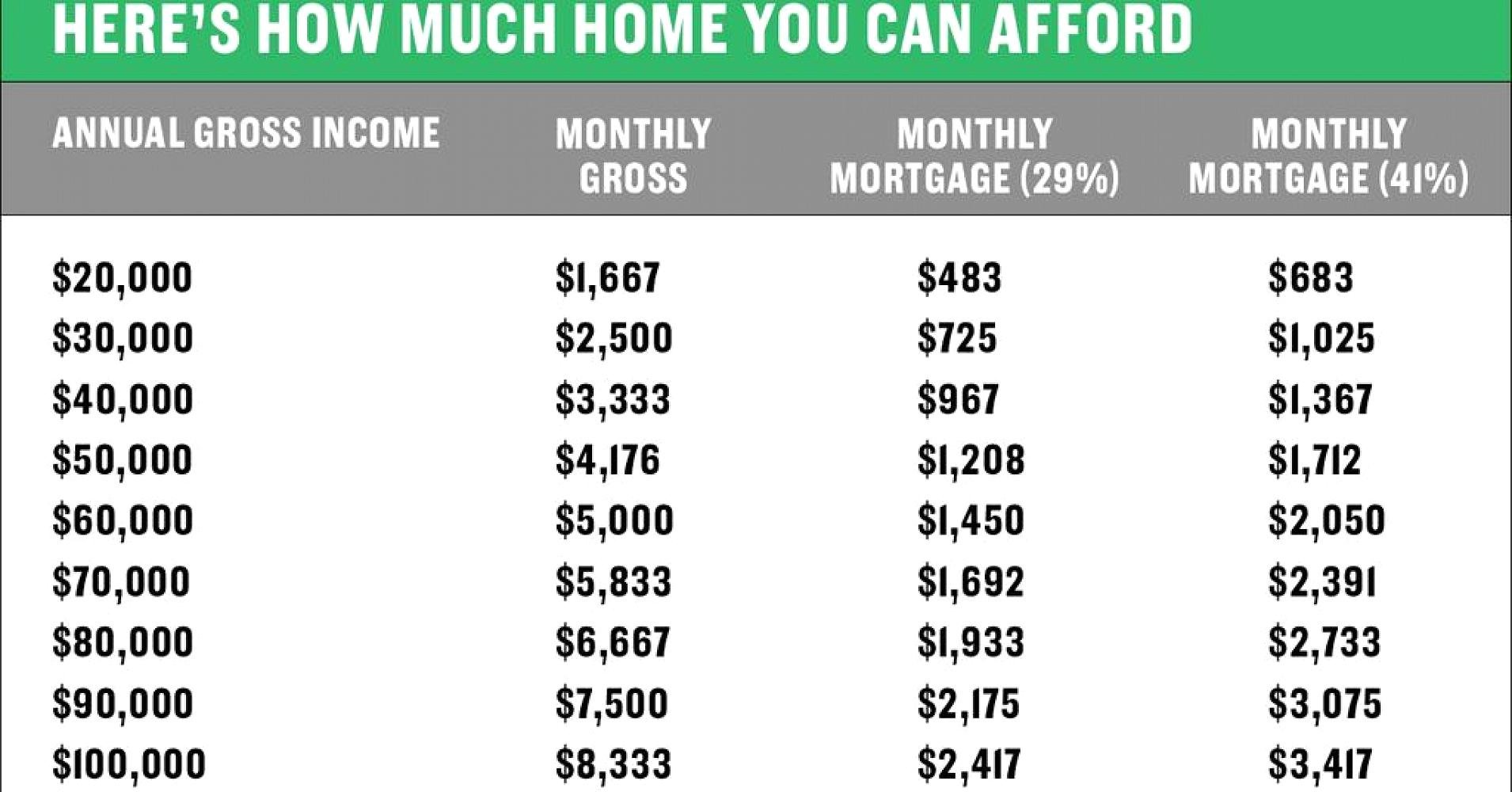

Use our Rate Calculator to find the rate and monthly payment that fits your budget. Homeowners have a few different options for tapping into their home equity to buy another home. Choosing the right one really depends on your financial situation and your goals.

Equity lines of credit usually have variable interest rates, which mean your payments could skyrocket over the course of time. Home equity loans tend to have shorter terms than regular mortgages, which means larger monthly payments to manage. If your payments fall well within your budget, then a cash-out refinance or equity line may make sense, but if funds are tight, then the cons may outweigh the pros. Since lenders consider investment property loans as riskier compared to traditional mortgages, they sometimes require a higher down payment. A home equity loan can help you come up with enough cash to cover this.

Her expertise includes mortgages, credit card rewards, and personal finance. Instead of giving up your dream, you can postpone buying another property until you can afford the down payment on your own. Start to save by regularly putting money into a high-yield savings account that you won’t touch.